ESG (CFA institute)

ESG (CFA institute) is a global credential in the field of ESG. Owned, managed and awarded globally by the CFA Institute, it provides practical application and technical knowledge in the fast-growing field of ESG investing.

The associated curriculum and learning materials have been developed by practitioners and are endorsed by the United Nations Principles for Responsible Investment (PRI). Highly recognised in the field of sustainable investment and green finance.

ESG (CFA institute) Course Introduction

ESG (CFA institute) Course Introduction

| Comprehensive course system, taught by skilled instructors | |

| Classic early reading class | |

| Classic early reading class | Classic early reading 1: "Climate Economy and Human Future" |

| Classic early reading 2: "Cake Economics" | |

| Classic early reading book 3: "Our Choice of Future" | |

| ESG General Education Course | |

| ESG application process guide | |

| Stage Two: Strengthening Theory | |

| Basic Premium Course | Chapter 1: ESG Introduction |

| Chapter 2: ESG Market | |

| Chapter 3: Environmental Factors | |

| Chapter 4: Social Factors | |

| Chapter 5: Governance Factors | |

| Chapter 6: Participation and Management | |

| Chapter 7: ESG Analysis, Valuation, and Integration | |

| Chapter 8: ESG Integrated Investment Portfolio Construction and Management | |

| Chapter 9: Investment Authorization, Investment Portfolio Analysis, and Client Reports | |

| Enhanced Speed Course | Detailed explanation of key knowledge |

| Exam classic question practice | |

| Last-minute preparation | |

| Stage Three: Practical Improvement | |

| ESG report writing practical course | Understanding the concept of sustainable development |

| Recognizing the dual importance of ESG disclosure principles | |

| Understanding international and domestic ESG disclosure standards, including exchanges, international organizations, and rating agencies | |

| Capable of interpreting ESG reports issued by companies from a professional perspective | |

| Master the implementation process and preparation procedure for ESG reports, able to organize and write ESG reports | |

| ESG report sand table simulation class | Deeply understand the various stages of report writing, and easily get started with practical application |

| Learning results are visualized, and personal report works can be used for job applications and interviews | |

| After the work is reviewed and approved, you will receive an ESG project practice certificate | |

| The work will serve as the basis for selecting the real ESG consulting project | |

| Stage Four: Strengthening and Expansion | |

| ESG Investment Strategy Course | Deeply and clearly analyze the ESG investment strategy, opportunities, and challenges in the financial industry |

| Trend analysis, quantitative valuation, investment decision, multi-dimensional understanding of investment strategies | |

| Deeply analyze real corporate cases, turning theory into practice | |

| Industry ESG Report Reading Course | Comprehensive and in-depth interpretation of industry ESG report |

| Sharing best practices in ESG practices and disclosure | |

| Providing analysis frameworks for investors and other stakeholders | |

| Basic knowledge of ESG investment | Mastering essential financial investment topics to build long-term competitiveness |

| Key knowledge string lecture, building financial investment knowledge map, cultivating investment mindset | |

| Exploring the core of value investment, analyzing the essence of finance from both macro and micro perspectives | |

| Industry Expert Course | Communicate with senior industry experts, learn the latest market trends, and deepen knowledge sharing |

| Clarify the latest developments in international sustainable issues and policies | |

| Understanding ESG concept and our country's "double carbon" strategy and deployment | |

| View key industries, regional transformations, and corporate practices | |

| 2024 ESG new course launched | |

| ESG Industry Report Interpretation Course | Selected ESG report reading, insights into eight industry trends |

| Dozens of excellent ESG cases from top companies, unlocking the core value of ESG | |

| 40+ hour course, taking you on a tour of the ESG industry | |

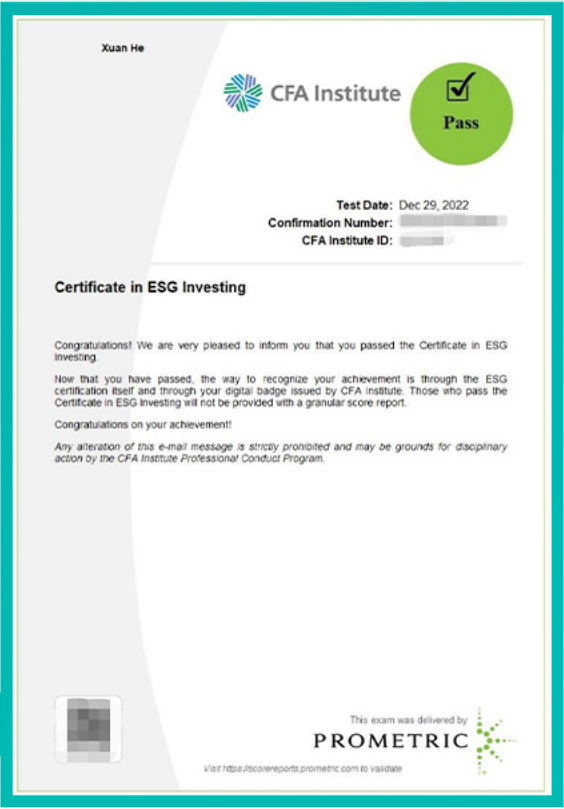

CFA-ESGExam

CFA-ESGExam

Exam Format

100 multiple choice questions, 3 choices, no case studies or calculations

Exam Duration

2 hours and 20 minutes to complete the exam.

Application period

6 months (after registration, you will have up to 6 months to arrange the exam)

Exam material

a 588-page full English electronic textbook + mock questions

考试方式 (两种)

①On-site testing at a testing centre (IST)

②Online Process Testing (OPT)

Who is suitable to study ESG?

Who is suitable to study ESG?

Practitioners

Practitioners whose daily work is related to ESG, such as green finance, ESG research, carbon trading, consulting organisations, etc., and who want to continue to cultivate in the field of ESG.

Working people

Working people who have self-improvement plans and expect to switch to other potential career tracks, and want to find a job that is not internally related. (Main industries: real estate, new energy, Internet technology, chemical industry, finance, finance, environment, etc.)

Middle and senior management

Middle and senior managers who are currently working in companies and organisations with business and sustainable transformation needs can learn ESG to help corporate executives and managers better understand and manage corporate environmental, social and governance issues. They can improve their organisation's reputation, attract investment and enhance performance by improving their company's ESG performance.

Current Undergraduate/Graduate Students

- Students majoring in the following fields who wish to enhance their extra competitiveness in the job search process such as autumn recruitment, spring recruitment, internships, etc., and whose thesis is related to the selected topics of ESG, carbon neutrality, etc.:.

- Finance, economics, business analysis, environmental engineering, etc.

- Chemical, energy, power, machinery, civil engineering and other majors

- Accounting, auditing, statistics, mathematics, computer science, etc.

- Management majors such as business administration, environmental management, energy management, etc.

- ESG related majors such as sustainable development, social responsibility, climate risk, etc.

- Architecture, urban construction, environmental protection, agronomy, sociology, communication, etc.

Certified ESG Analyst

Exam Introduction

The Certified ESG Analyst exam is divided into three levels: primary, intermediate, and advanced according to the knowledge and closeness to the actual business, focusing on the assessment of ESG introduction, ESG core knowledge structure, and ESG business application respectively.

Taking the syllabus of the Advanced Certified ESG Analyst exam as an example, the exam mainly includes.

- i

ESG disclosure standards and ESG reporting

- ii

ESG data analysis

- iii

ESG rating

- iv

ESG regulation

- v

Due diligence management

- vi

ESG portfolio investment strategy

- vii

Frontier hotspot analysis and other seven dimensions of assessment

Exam Format

Suggested applicants

undergraduate and above discipline students, including but not limited to.

Finance, economics, environment, law, energy, biochemistry, construction and other professional college students.

Corporate ESG positions.

Members of the Board of Directors' Sustainability Committee, senior executives (CE0, CFO, CI0, CRO, etc.), risk management positions, investor relations positions, internal control and compliance positions, financial positions.

ESG rating and consulting direction.

ESG consultant, M&A business ESG due diligence research, audit business (ESG), ESG rating, etc.

ESG investment and financial direction.

Commercial banks (including but not limited to lending business, risk management, green credit, etc.), insurance companies (including but not limited to product design, ESG investment), securities companies (including but not limited to wealth management, brokerage business, investment banking, institutional business, research business), asset managers, fund managers, family offices, private banks, high net worth customer service.