In response to the recent heated discussion regarding the "0% phospholipid content" incident of its Antarctic krill oil products, Beijing Tong Ren Tang Co., Ltd. (Tong Ren Tang, 600085.SH) issued a clarification announcement on the 18th to address market concerns.

The announcement shows that the company does not directly or indirectly hold any equity or investment rights in Beijing Tong Ren Tang (Sichuan) Health Pharmaceutical Co., Ltd. (hereinafter referred to as "Sichuan Health Pharmaceutical"). The involved distributor, Sichuan Health Pharmaceutical, is a controlled subsidiary of Beijing Tong Ren Tang Health Pharmaceutical Co., Ltd. (hereinafter referred to as "Tong Ren Tang Health"), which itself is under Beijing Tong Ren Tang (Group) Co., Ltd. (hereinafter referred to as "Tong Ren Tang Group"), the controlling shareholder of Tong Ren Tang. Furthermore, the company stated that all its medicines are produced independently, and there is no outsourcing of production to external third parties.

Subsequently, Tong Ren Tang Group also issued a statement on the 20th regarding the Antarctic krill oil issue, stating that it had immediately launched a zero-tolerance brand strict management campaign to fully protect consumer rights.

Although the involved company is not a subsidiary of the listed entity Tong Ren Tang (600085.SH), the market has repeatedly focused on controversies related to the use of the Tong Ren Tang brand within the group system and its licensing in recent years. This has exposed the time-honored brand to certain reputational spillover risks in terms of public perception. Such incidents also suggest that, while continuously improving its own compliance boundaries, listed companies still need to pay long-term attention to the construction of brand licensing management and risk isolation mechanisms to reduce potential reputational impacts from a governance perspective.

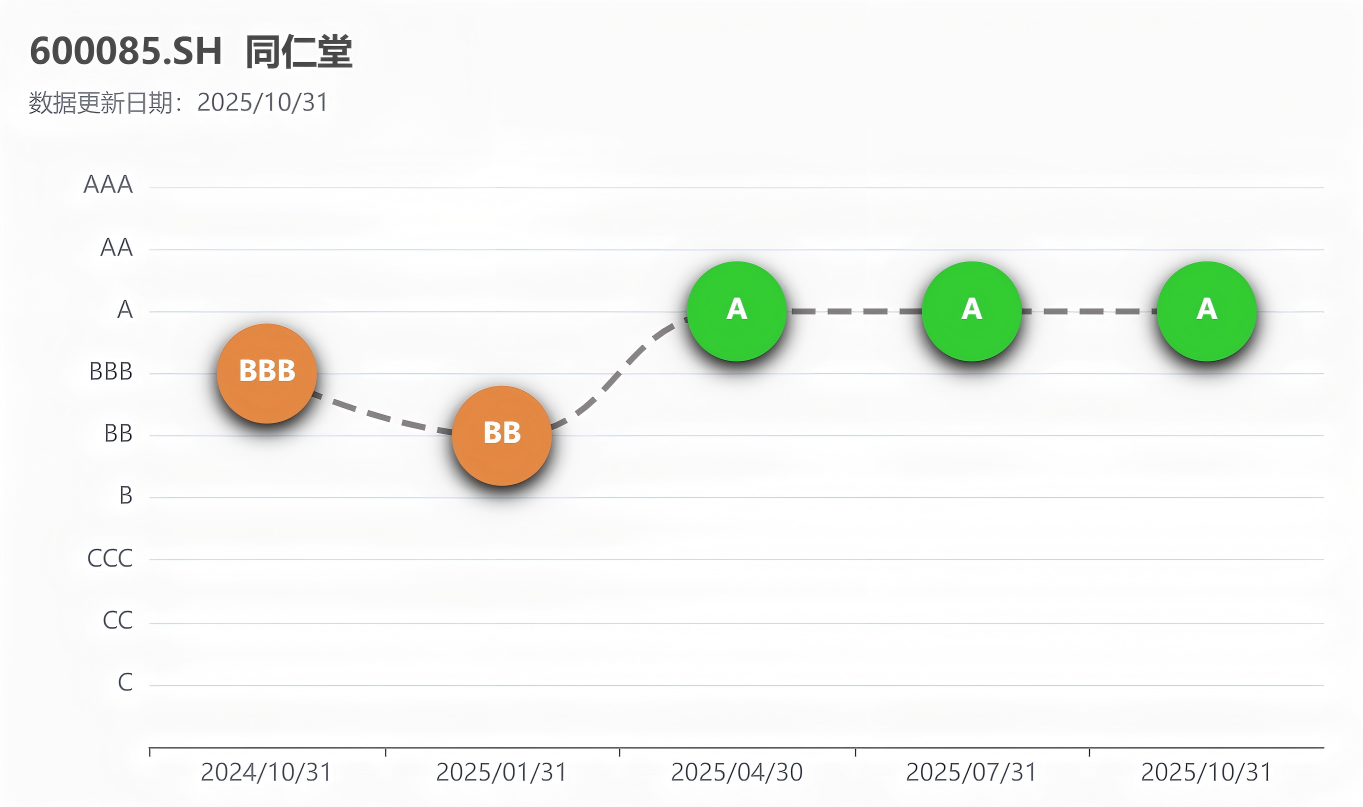

From an ESG performance perspective, in the latest ESG rating results (as of October 31, 2025) released by China Securities Index, Tong Ren Tang (600085.SH) maintained its Grade A rating. Looking at the three dimensions of E, S, and G, the company's performance in the Environmental and Social dimensions is relatively stable. Its Governance dimension is within the average range for the entire market, indicating overall stable ESG performance.

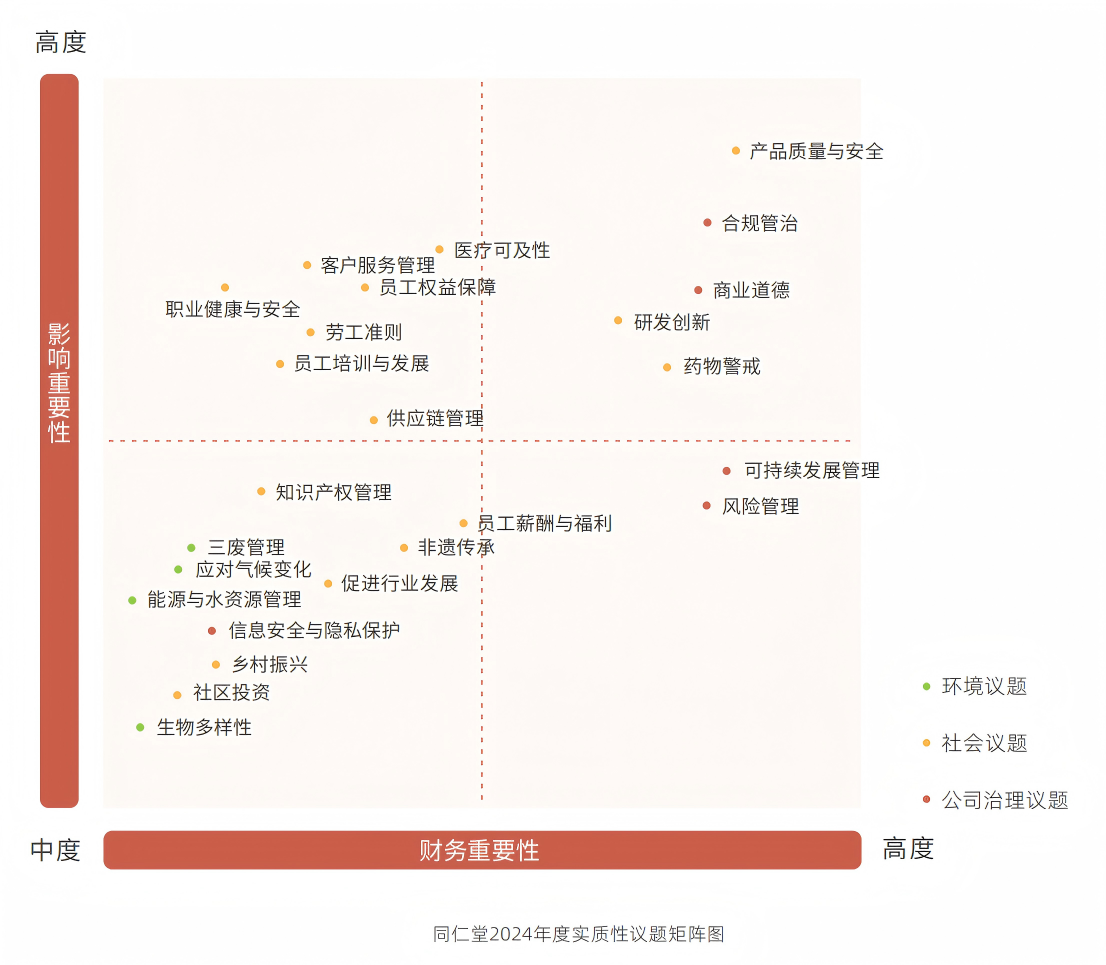

Based on its published 2024 ESG Report, the report demonstrates a relatively complete disclosure framework and strong overall compliance. However, the ESG report has not yet undergone external assurance. During the period, the company identified a total of 25 ESG issues, among which "Product Quality and Safety," "Compliance Governance," "Business Ethics," "R&D Innovation," and "Pharmacovigilance" were identified as having high dual importance, reflecting the company's focus on core operational risks and social responsibility issues.

In the Governance dimension, the company disclosed information regarding board governance, compliance management, and internal controls. As of the end of the reporting period, the company's board consisted of 11 members, including 4 independent directors (36.36%) and 6 female directors (54.55%). During the reporting period, the company did not receive any penalties for violating information disclosure regulations and enhanced market communication through convening shareholder meetings, earnings briefings, and responding to investor inquiries. Overall, the company maintains high stability in compliant operations. However, governance-related disclosures still lean towards a "zero-risk narrative," and there is room for improvement in the quantitative disclosure of whistleblower mechanism operations, identified governance risks, and remediation progress.

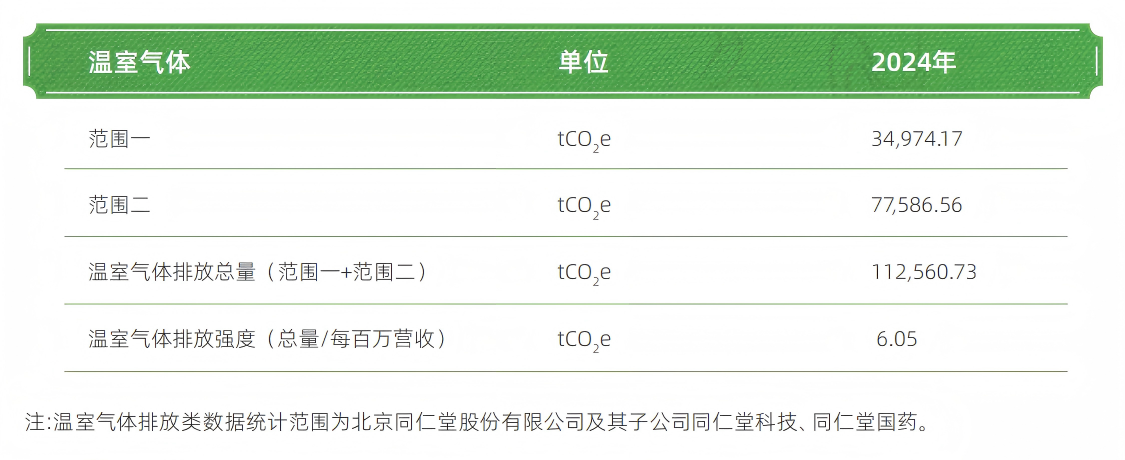

In the Environmental dimension, the company disclosed key indicators such as energy consumption, water usage, greenhouse gas emissions (Scope 1 and 2), emission intensity, and environmental protection investment, and clarified the statistical scope of the data. Initiatives like green factory construction, clean production audits, and the use of new energy vehicles reflect that the company has established a certain foundation in green operations. During the reporting period, the company identified and assessed climate-related risks and opportunities from the perspectives of impact cycle and potential financial impact. It also proposed a carbon peak-related governance structure and long-term goals, aligning with the national "dual carbon" policy direction. However, a clear phased emission reduction pathway has not yet been formed, systematic disclosure of Scope 3 emissions data has not begun, and historical data comparisons need strengthening.

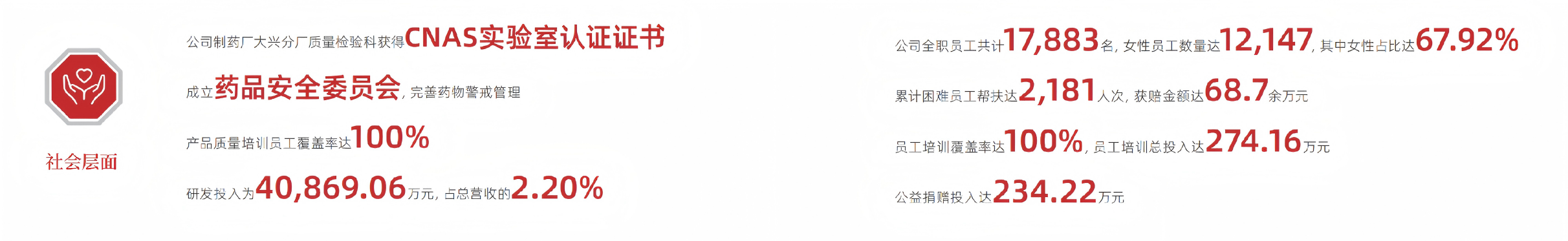

In the Social dimension, the report fully reflects the characteristics of the pharmaceutical industry, focusing on the disclosure of product quality management, pharmacovigilance systems, employee training and welfare, occupational health and safety, and public welfare contributions. Among these, the establishment of a three-level pharmacovigilance management structure (Drug Safety Committee — Pharmacovigilance Office — Relevant Functional Departments) is a significant highlight of the company's social responsibility management. Regarding product safety, the company disclosed a zero product recall rate during the reporting period. However, the disclosure of process information such as adverse reaction monitoring data, risk identification frequency, and improvement mechanisms is relatively limited.

Overall, Tong Ren Tang's 2024 ESG report demonstrates robustness in terms of compliance and disclosure completeness. The foundations in the Environmental and Social dimensions are relatively solid, and there is room for continuous improvement in the ESG management system. As the focus of disclosure gradually extends towards management effectiveness and risk transparency, the quality of its ESG information and its market recognition are expected to further improve.

Author:Qinger