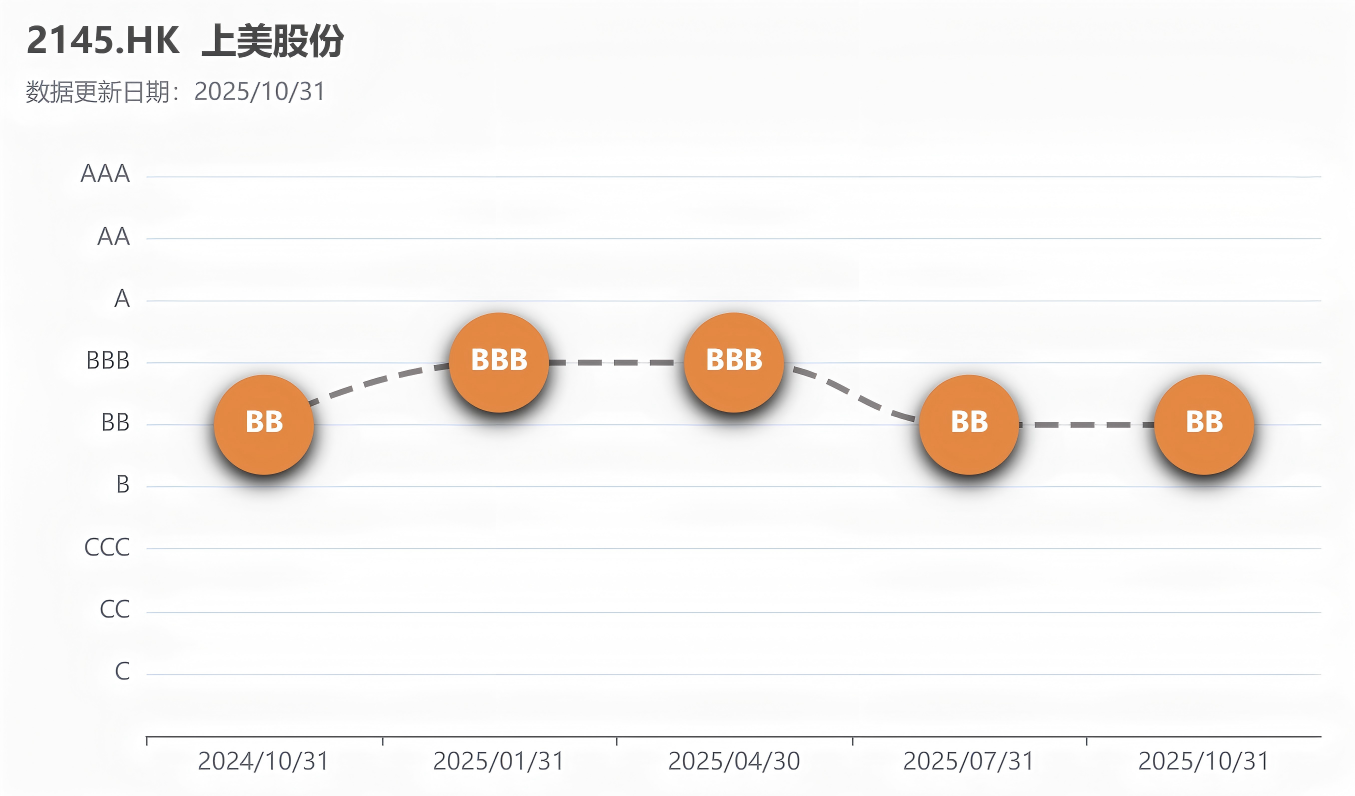

In the latest ESG rating results released by China Securities Index on October 31, 2025, Chicmax (02145.HK) maintained its BB rating. Its overall ESG performance remains in the upper-middle range of the entire market, ranking 9th out of 19 in the GICS Level 3 Industry of Personal Care Products.

The company has disclosed ESG reports for three consecutive years, with its recent ESG level remaining generally stable. Its performance across the Environmental, Social, and Governance (E, S, G) dimensions is around the overall market average. In corporate governance, the company has established a sustainability governance structure comprising the Board of Directors, an ESG working group, and various functional departments. However, its ESG report disclosures primarily focus on describing frameworks and systems, and the company has not yet obtained external assurance for its ESG report.

Regarding the environmental dimension, the company has not received any related penalty information in the past three years. According to its 2024 Annual ESG Report released in early 2025, the report outlines specific company initiatives in areas such as green packaging, clean energy, and waste management. For instance, 95% of new products from the Yizhibao brand and items from the newpage ONE PAGE brand use FSC® certified eco-friendly paper for packaging; the factory has adopted clean energy, cumulatively generating over 7.7 million kWh of solar photovoltaic power; and the 2024 greenhouse gas (Scope 1+2) emission density decreased significantly by 27% compared to 2023. However, the systematic and forward-looking nature of its environmental management is notably insufficient. Although the company has set green goals for energy conservation, emission reduction, water saving, and waste reduction, it has not established mid-to-long-term Science Based Targets (SBTi). Carbon emission disclosures only cover Scope 1 and Scope 2, with Scope 3 emissions not yet accounted for.

The social dimension is a highlight area in the company's ESG practices. The ESG report emphasizes clean beauty, R&D innovation, product safety, and employee care. In 2024, the company successfully filed its self-developed "Cyclohexapeptide-9" and released the 2024 Super-Frequency Technology Anti-Aging White Paper and the Clean Beauty Industry White Paper. It also established a 10 million RMB "Employee Family Marriage and Childbearing Security Fund." Female employees account for 59% of the workforce, with women holding 40% of senior management positions. However, employee turnover is relatively high, particularly the female employee turnover rate reaching 50%. The report does not delve into the reasons for this or the effectiveness of improvement measures. In terms of supply chain management, the report only mentions the number of key cooperative suppliers and does not disclose critical information such as ESG audit coverage rates or rectification of violations.

In July 2025, internal chat records of the company's founder, Lu Yixiong, expressing opposition to overtime work were exposed, sparking heated discussions. However, this "anti-involution" declaration faced skepticism from some employees who questioned that under the existing "horse racing" performance mechanism, workloads had actually increased instead of decreasing, with some employees claiming that previous overtime meal allowances had been canceled. Furthermore, Lu Yixiong's remarks in early 2025 about "employee transformation in the AI era" also stirred controversy. He suggested using AI tools to largely replace human labor, with elimination rates in some departments reportedly as high as 95%. Although he later clarified that the company overall would increase headcount, aiming for "scientific operation," this radical statement had already sparked widespread debate, reflecting a gap between the company's management culture and the "employee development" advocated by ESG principles.

Regarding product quality and safety, a report by CCTV's "Economic Half-Hour" program on December 25 stated that Kans brand's "Volumizing & Firming Essence Mask" and "Brightening & Radiance Mask" were found to contain the prohibited cosmetic ingredient Epidermal Growth Factor (EGF), with levels of 0.07 pg/g and 3.21 pg/g respectively. In response, Kans issued a statement and test reports on the 27th, saying: "Upon learning of the report, we immediately initiated comprehensive self-inspection and traceability procedures. As early as November 2025, the Inspection Bureau of the Shanghai Municipal Drug Administration had conducted on-site verification and testing of the product. For objective fairness, samples were sent for testing to both parties, and results from both indicated that the submitted samples did not contain the human epidermal growth factor (EGF) ingredient." However, Kans has not yet provided a clear explanation for the discrepancy between the two test results. Affected by this, Chicmax's stock price fell by over 13% in a single day on December 29.

Analysis suggests that differences in testing methods might be one reason for the conflicting results. However, product quality and consumer safety are core issues. How to further enhance testing transparency and the credibility of quality control will remain a key focus for the market.

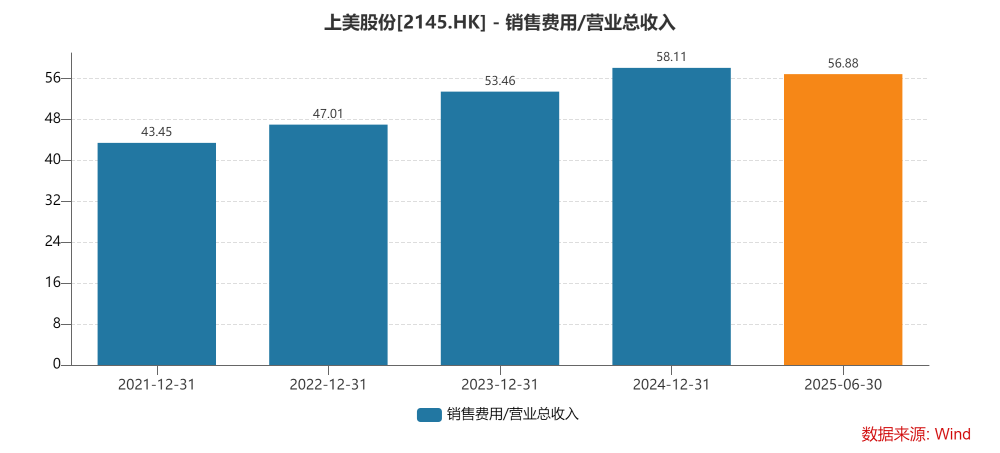

Chicmax's portfolio includes brands such as Kans, Yizhibao, Elephant Red Baby, and newpage ONE PAGE. In recent years, Kans, positioned as "science-based anti-aging," has performed remarkably well: achieving revenue of 5.591 billion RMB in 2024, an 80.9% year-on-year increase, accounting for 82.3% of total revenue; and revenue of 3.344 billion RMB in the first half of 2025, a 14.3% year-on-year increase, accounting for 81.4% of total revenue. Chicmax's reliance on a single brand is intensifying. Concurrently, the company's sales expense ratio has risen from 47.01% in 2022 to 56.88% in the first half of 2025, reaching as high as 58.11% in 2024; meanwhile, its R&D expense ratio has decreased from 4.12% to 2.51%.

Furthermore, while the ESG report lists both "R&D and Innovation" and "Product Quality and Safety" as the most significant issues, the R&D cost in the first half of 2025 was only 103 million RMB, whereas sales and distribution expenses amounted to 2.337 billion RMB. This reveals the substantive prioritization in resource allocation, and the stark contrast between the two has also attracted external attention.

Author:Qinger